Save Money Live Better! – Tips to Help Build Your Savings Account

This post contains editorial samples and/or affiliate links to products I recommend. While this adds no additional cost to you, I will earn a small commission on any sales made.

Life has its fair share of curveballs. No matter how prepared you are, how secure you feel in your life, or how assured you are about the stability of your finances, one turn of events can make you feel otherwise. No one wants bad things to happen, but you can change what happens during these life events by planning and creating a cushion to fall back on if needed. The phrase “Save Money Live Better” can become a way of life!

Tips to Help Build Your Savings Account

Start Tackling Your Debt

To determine how much money you need in savings, you should add up your monthly financial expenses and multiply that by six.

Your savings should be enough to cover six months of your regular finances.

That might seem like a lot of money, especially to those with debt, but there are things you can still do to help your finances.

One way is through secured personal loans, which help you consolidate all of your debt, making it more manageable.

Loans are given in one lump sum that you use to pay debts you owe, such as medical bills and credit cards.

If you cannot pay off all your debt at once with a loan, try to focus mainly on those with the highest interest rates.

By reducing the amount of debt you have, you will be able to have more money left over to add to your savings account.

Use Coupons to Save Money

The cost of living is high, and coupons can help you save money on the things you have to buy for your household.

Clipping coupons and using them efficiently can seem like a chore, but you’ll end up saving a lot of money in the long run.

If you’re new to couponing, it’s good to learn the stores’ coupon policy you shop at the most.

If you’re not sure, you can always find this information on the web.

When researching, it’s good to learn about rainchecks, price matching, and competitor coupons when researching. Stacking coupons is one way to save the most money, and this is when you combine a coupon with a store sale.

Sometimes, you can stack manufacturer’s coupons with store coupons, which results in even more savings.

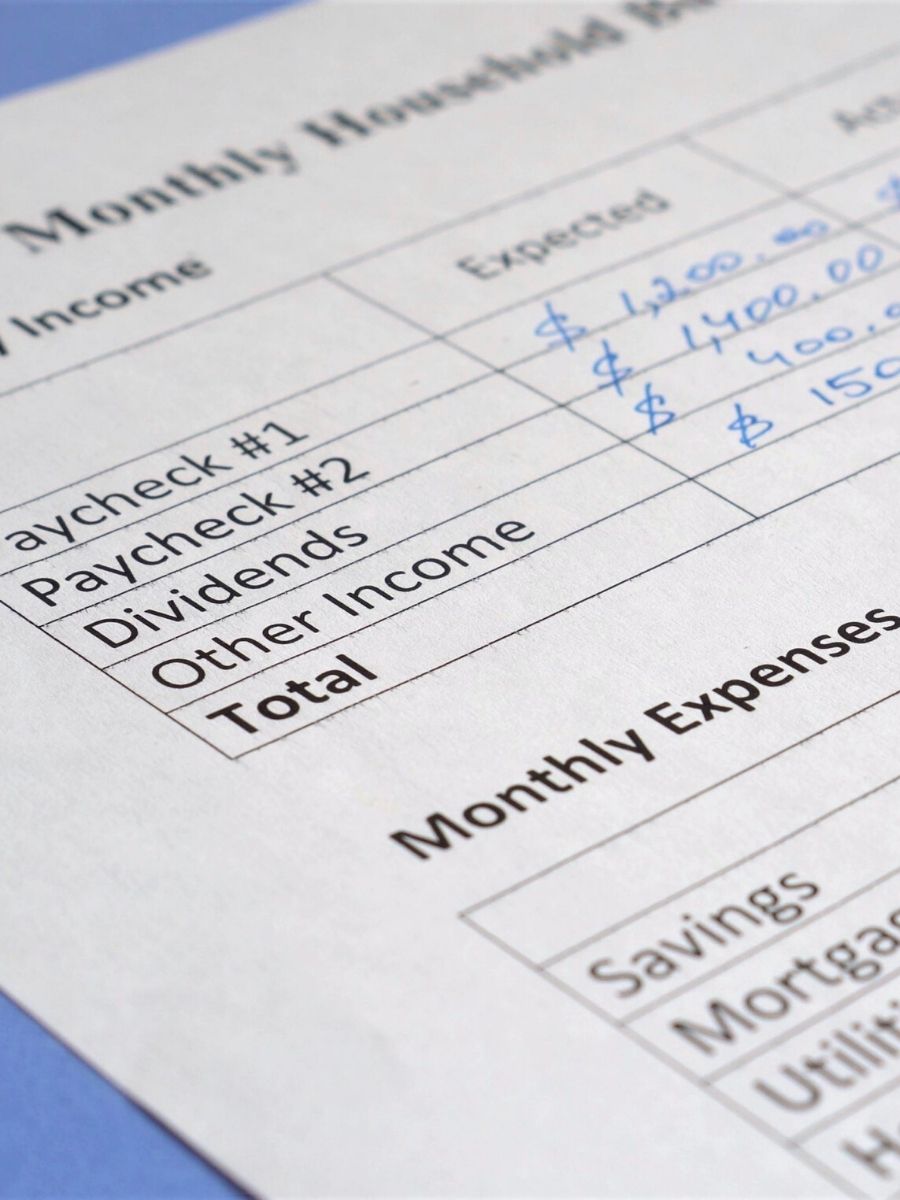

Record All of Your Expenses

It’s hard to know how much you’ll need to save without knowing how much you spend monthly.

You will need to set aside some time and go through your bank and credit card transactions to see where you spend money.

Make a list of these expenses and separate them from high priority transactions such as mortgage payments or electric bills to low priority such as your daily trip to the coffee shop.

Create a Budget

One way to have more money to add to savings is to create a budget and stick to it.

Once you record all of your expenses, you’ll be able to see exactly where your money goes each month.

This will help you determine where you might be able to cut down on some spending.

Prioritize your needs and try to cut back on your wants to work towards that goal to grow your savings account.

Earn Extra Money

Depending on your finances, it might be a good idea to get a side hustle for some extra money.

This can be anything from a part-time job at a retail store to freelance writing or even dog walking.

If you get another income coming in for the sole purpose of paying off your debt and adding to it, make sure it all goes into your savings.

Try not to use that money for anything else.

Finance Tips To Help Save Money for Your Family!

A savings account should be a priority no matter how old or young you are.

Emergencies happen when you least expect them to, and being prepared for these emergencies will make a huge difference.

Remember, save more live better!